Investment Objectives

The Endowment's primary investment objective is to provide a sustainable maximum level of return consistent with prudent risk levels. The investment policy's specific objective is to attain, through appreciation and income, a long-term annualized total return (net of fees and expenses) of at least 5 percent plus the rate of inflation. It is recognized that support for current operations must be consistent with the long-term growth of the Endowment. While shorter-term investment results will be monitored, policy dictates adherence to a sound long-term investment program, which balances short-term spending needs to preserve the real (inflation-adjusted) value of assets to achieve intergenerational equity.

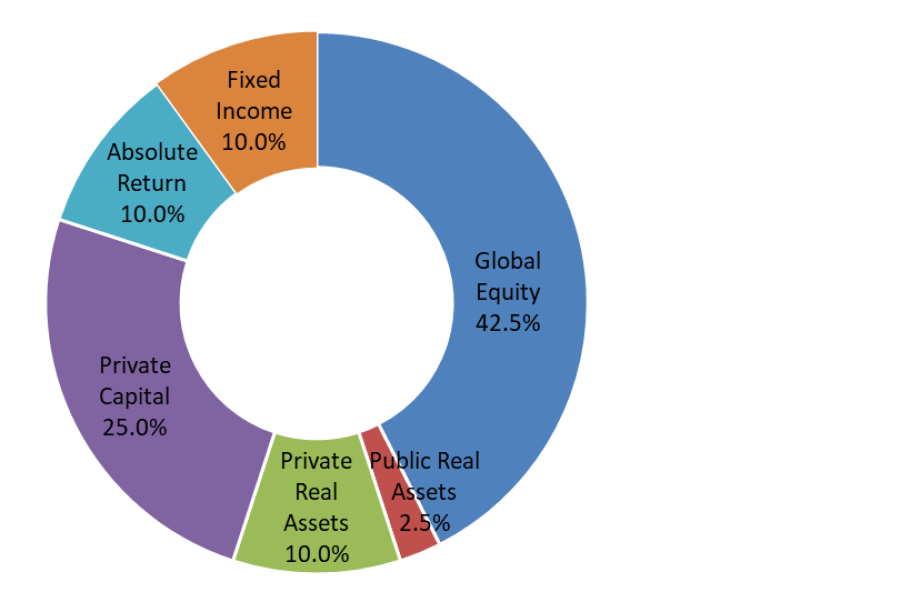

Policy Target Asset Allocation

The Endowment's target asset allocation is designed to deliver the long-term total return required to grow the endowment while minimizing changes in asset values that may disrupt funding for the programs it supports.

Puget Sound’s complete pooled endowment investment policy, including spending policy, is available on the Finance & Administration Policies page.