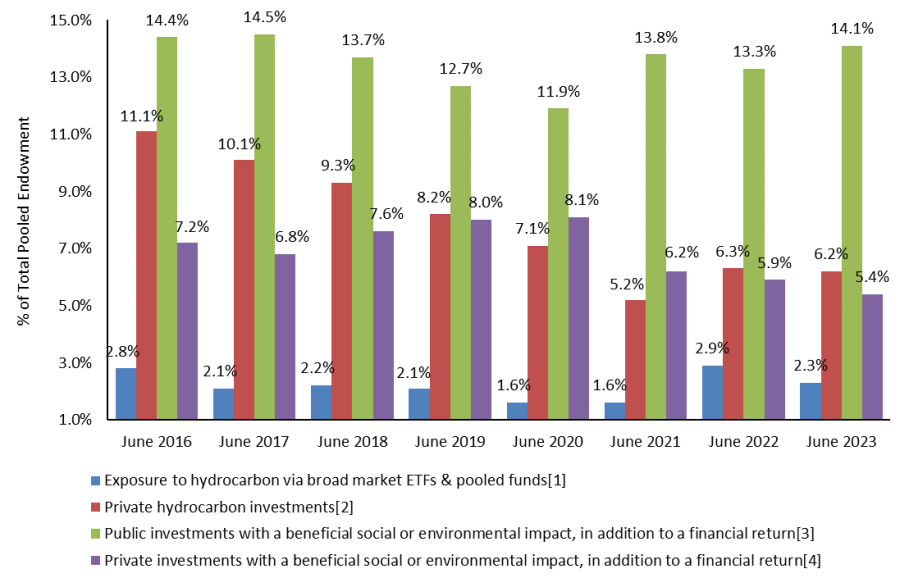

As the Commitment to Reduce Fossil Fuel Investments in Our Endowment is implemented and illiquid private investments mature over the next seven to ten years, exposure to fossil fuel investments in the endowment is expected decline.

The university measures the percentage of the portfolio invested in hydrocarbon at the end of each fiscal year and updated the graph below following the board’s fall meeting. The increase in exposure from 2021 to 2022 was from positive investment returns in this sector relative to market declines in other asset classes. There were no new private hydrocarbon investments.

The university also tracks the portfolio’s holdings in investments with a beneficial social or environmental impact, in addition to a financial return, which is reflected in this graph as well.

[1] Exposure to Hydrocarbon via Broad Market ETFs & Pooled Funds is measured using the MSCI Fossil Fuel Reserves list as a screen beginning June 2019 (Carbon Underground 200 was used as a screen through June 2018).

[2] Private hydrocarbon investments have a primary investment strategy focused on hydrocarbon extraction, processing, and/or transportation.

[3] Public investments with a beneficial social or environmental impact, in addition to a financial return, are measured using the Dow Jones Sustainability World Index as the screen.

[4] Private Investments with a beneficial social or environmental impact, in addition to a financial return, include investments in renewable energy, timber, healthcare technology, life science, and investments based on environmental, social, and governance (ESG) criteria.